CRED launched RentPay, a service to pay rent online, on their mobile app yesterday. RentPay will enable users to pay rent to their landlords using a credit card as well as UPI.

Amidst COVID-19 lockdown, the regular cash flow of individuals has been impacted severely. CRED RentPay tries to combat the situation by improving liquidity for the short term. One can pay the rent using a credit card and hold on to cash in these uncertain times.

In this article, I am going to give my first impression of the service and a review. So without further ado, let’s get into the details to know more about RentPay.

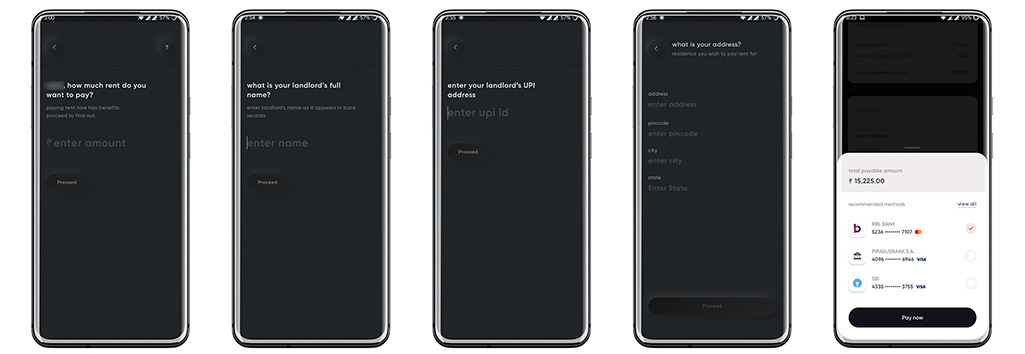

CRED RentPay enables the users to pay the rent to their landlords using credit cards or UPI. Users need to provide minimal details to pay the rent and the amount gets transferred seamlessly to landlords’ bank accounts. There is no need to provide rental agreement or any other document as of now.

Process

Overall RentPay is incredibly intuitive to use and the process is really straightforward. Just enter the amount you wish to pay, details of your landlord like name, bank account details/UPI handle and your current address. The rent gets instantly transferred to the landlord’s account. There are other fin-tech startups as well that allow you to pay your rent via Credit Card. But CRED has nailed down the experience and their seamless 3-step rent transfer is unmatched at the moment.

Benefits

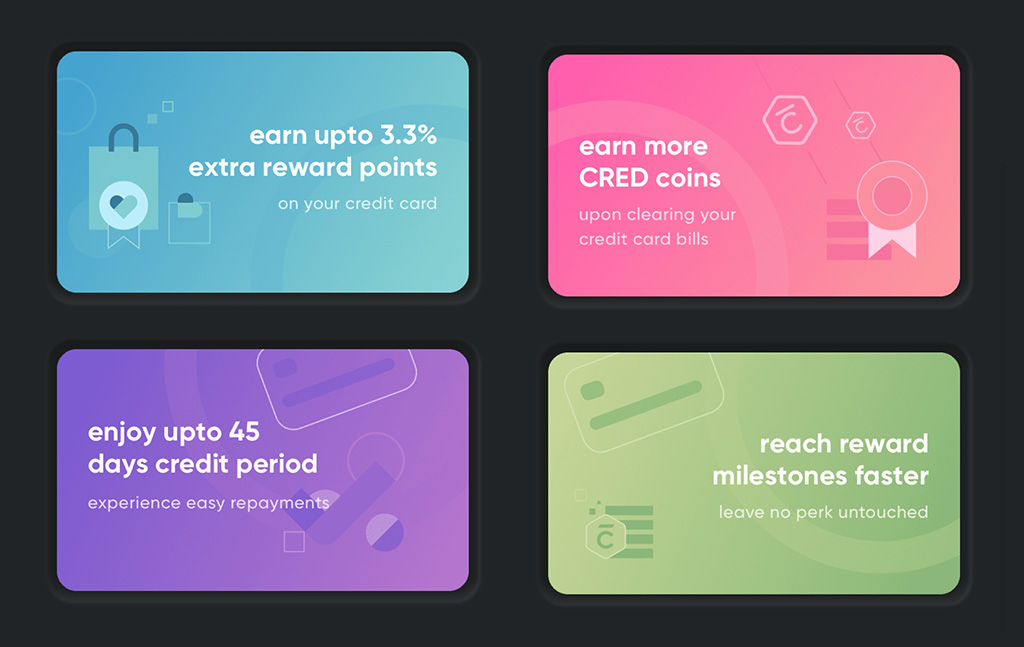

Paying rent via credit card unlocks access to many perks that otherwise would not have been accessible through cash:

- On paying rent via credit card, you can earn credit card rewards. Some super premium credit cards like HDFC Infinia and Diners Club Black provide handsome reward rate of 3.3%.

- You can reach credit card milestone benefits faster by paying rent through credit cards. These milestone benefits offer you extra reward on top of existing base reward rate.

- You can also enjoy up to 45-50 days of interest free credit period (depending on credit card billing cycle) and earn interest on money laying in your bank account.

- By paying rent via credit cards, you can easily reach your spending target for annual fee waiver of your credit card.

If you pay rent via credit card on CRED and again use CRED for clearing out credit card dues, you earn CRED Coins. CRED Coins can be exchanged for exclusive rewards from premier brands and curated experiences on CRED app.

I mostly spend CRED coins on dining benefits where I exchange these for a flat discount up to 20% at various popular restaurants and pubs in Bangalore. I also exchange these coins for philanthropic campaigns where CRED partners with non-profit organizations. I really love this idea and have huge respect for CRED for enabling us to participate in these campaigns.

Charges

- Credit Cards: Up to 1.5% of rent amount

- UPI: Nil

CRED currently charges up to 1.5% of rent as service charges using Credit Card which I feel is competitive in the current market. You can easily recover this charge if you use one of the best rewarding credit cards in India, e.g. Flipkart Axis Bank Credit Card, Indusind Iconia Amex Credit Card, Yes First Exclusive Credit Card etc. You can even gain more if you use some of super premium credit cards like Standard Chartered Ultimate Credit Card, HDFC Infinia, Diners Club Black etc. These credit cards provide a reward rate in tune of 3.3% and hence you can get a net benefit of 1.8% which is quite good.

Eligibility

RentPay has been rolled out by CRED to a small set of CRED users for now. They’ll be rolling out this to more users over the next 2 weeks. So if you get in early, make sure to try the product and earn additional points on your card as well as CRED coins.

Verdict

CRED RentPay tries to bring some liquidity in this cash-starved market due to CoronaVirus. CRED RentPay not only enables you to earn extra rewards on your credit card, but also accelerates your journey towards milestone benefits and fee waiver based on spends. Though there are service charges for using this service, if you use the right credit card, you’ll end up gaining, rather than losing.

Finally CRED has nailed down the user experience for RentPay. The entire process is frictionless and intuitive for end users. I simply loved their instant 3-step rent transfer process. I wish more and more players in the fin-tech space follow suit, making the overall ecosystem better.

Don’t have CRED? Get it now to claim your exclusive rewards and benefits from link below:

PS: CRED has also launched an instant personal credit line CRED Stash. Read more about CRED Stash here.

What do you think of CRED RentPay? Have you used similar kinds of services in the past? Let me know your experience by leaving a quick comment below.