Beyond the horizon of regular credit cards, which are available to masses, there exists a world of exclusive credit cards which are available to ultra rich and famous. These credit cards are mostly invite only with no pre set credit limit. To get invited, you need to have really high income and relationship with the banks issuing them. These credit cards are curated to cater the frivolous lifestyle of the rich and famous. Here’s everything you need to know about the world’s top 10 exclusive credit cards.

- 1. American Express Centurion Card

- 2. Dubai First Royale Mastercard

- 3. Sberbank Visa Infinite Gold Card

- 4. JP Morgan Reserve Card

- 5. Coutts Silk Card

- 6. Eurasian Bank Diamond Card Visa Infinite

- 7. Stratus Rewards Visa Card

- 8. Citi Chairman American Express Card

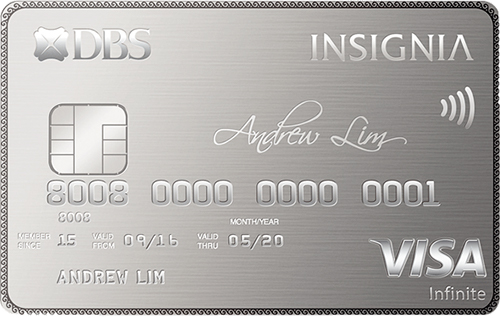

- 9. DBS Insignia Visa Infinite Card

- 10. UOB Reserve Card

- Bottomline

1. American Express Centurion Card

American Express Centurion Card, popularly know as the “Black Card” is most fabled card of this era. The card itself is made of anodized titanium with the information and numbers laser etched into the metal. This card is not available to public and Amex will invite you once you become eligible. It’s rumored that only those who spend (and pay off) at least Rs. 2 Crores in a year across all of their American Express accounts are invited to become Centurion Cardholders.

This card comes with a initiation fee of Rs. 5 Lakhs + GST and annual fee of Rs. 2 Lakhs + GST. Hence in first year, you end up paying Rs. 7 Lakhs + GST (~ Rs. 8.26 Lakhs) for this card. One add-on Centurion and five add-on Platinum Cards are provided for free with this card.

Some of the perks include compulsory upgrade from Business to first class in Etihad, 50% of on Oberoi Suites, no fee on foreign transactions etc. Some airports even have luxurious lounges that are free for Centurion users. There are likely many other benefits you’ll find out about once you become a card member - if you’re ever invited.

2. Dubai First Royale Mastercard

Issued by Dubai First Bank, Dubai First Royale Mastercard features two sides trimmed with real gold and a solitary 0.235 carat diamond studded at the front. This card is invite only and Dubai First Bank is tight-lipped about the requirements for an invitation.

This card comes with no spending limit and a dedicated relationship manager and a lifestyle manager. From renting an yacht to buying one, this card will get you through. The lifestyle manager can reportedly get you the last-minute tickets to Grammy’s, box seats to a sold-out Broadway play, private jet and many other things. The card comes with an annual fee of AED 7,000 i.e. Rs. 1.3 Lakhs. With only about 200 cardholders worldwide, it’s just not enough to be a multi-millionaire; you must also have the spending patterns and use for their exclusive services.

3. Sberbank Visa Infinite Gold Card

Sberbank Visa Infinite Gold Card goes way beyond Dubai First Royale Mastercard in number of diamonds. Sberbank Visa Infinite Gold Card is made of pure Gold and sports 26 diamonds and a mother of pearl. Issued by Kazakhstani Sberbank to only 100 of its top clients initially, this Visa Infinite card costs a neat $100,000 up front. It reportedly costs $65,000 to make the card itself and cardholders must have a minimum of $35,000 in the bank account associated with the card. The card also has a $2,000 annual fee.

This card offers $250,000 of life and health insurance, 24/7 concierge service, a free iPhone and a personal manager at Sberbank. It also enables VIP access to luxury vacations and the world’s finest golf courses. That said, once you have the card, you won’t be charged any late-payment fees. Pretty neat, isn’t?

4. JP Morgan Reserve Card

JP Morgan Reserve Card, formerly known as the Palladium Card, is offered by invitation only to JP Morgan’s top clients, who must have at least $10 million in assets under management by JP Morgan Private Bank. The card is made of Palladium and weighs approximately five times as much as a conventional plastic credit card.

This card comes with an annual fee of $450 and card members receive $300 in annual travel credits as well as complimentary airport lounge access. The card members can earn 3X points on travel and dining and 1X points on everything else. There are no fees for foreign transactions, late payments, returned payments, or cash advances.

5. Coutts Silk Card

Coutts Silk Card is offered by Coutts Bank which is famous for having British Royal Family along with many of Great Britain’s richest and most famous citizens in its clientele. In order to get the Silk Card, you must first be a client of Coutts Bank - which in and of itself is no easy feat. If you try to apply online, you’ll be asked about your annual income and total assets, and if you don’t have either a £1 million to invest or an annual income of at least £500,000, you’ll just get a message that suggests an alternative banking option.

The Coutts Silk Card, unlike other cards in its segment, comes with no annual or membership fees. The card has no annual or foreign transaction fees and lets you enter airport lounges around the world through LoungeKey. Plus, you get access to exclusive events and experiences through the Coutts signature loyalty program, as well as 24/7 service from Coutts Concierge. Coutts Bank also provides tiered gifts to cardholders who charge £25,000 or more annually.

6. Eurasian Bank Diamond Card Visa Infinite

Eurasian Bank Diamond Card Visa Infinite was issued by Kazakhstani Eurasian Bank. This stunning black card featured an inlaid gold ornament with a 0.02 carat diamond centerpiece.

Although no longer available, you had to have a personal recommendation from either the Eurasian Bank’s Management Board or from two existing Eurasian Diamond cardholders to get this Visa black card. Elite cardholders enjoyed spending as much as they wanted with this no-limit black Visa card. With this diamond and gold card, cardholders used to get leading concierge services that helped them hire a butler or even arrange a private plane too.

7. Stratus Rewards Visa Card

Popularly know as the “White Card”, is available only to those invited or nominated to join and has a hefty annual fee of $1,500. It’s rumored that one must spend at least $200,000 a year with the card to remain a member.

This card features a rewards program that lets cardholders travel on private jets or charter flights. This card also provides access to personal concierge services, discounted charter flights, complimentary car services, luxury hotel upgrades, special events and exclusive gift bags. Another interesting feature, according to rumor, is that you can pool your points with friends, meaning you could all chip in on a private jet ride together.

8. Citi Chairman American Express Card

Citi Chairman American Express Card is available to Citi Private Bank Clients who have significant investments with a Citigroup brokerage account. This card comes with a credit limit as high as $300,000 and a relatively low annual fee of $500.

The concierge services can get you tickets to some of the best concerts, Broadway shows and sporting events. The travel perks on this card are extreme and include upgrades, access to private airport lounges etc. This card will also give you privileged access to special, extraordinary VIP experiences.

9. DBS Insignia Visa Infinite Card

DBS Insignia Visa Infinite Card is a invite only metal card issued by DBS Bank of Singapore. To get invited for this card, either you need to earn S$500,000 a year, or have S$3 million in assets with DBS. The annual fee for this card is S$3,000 + GST.

This card provides unlimited access to over 1,000 airport lounges worldwide using Priority Pass membership. Among other perks, it includes expedited immigration clearance in Asia, free 2 night hotel stay at select hotels, Club Hyatt membership and luxury yacht access.

10. UOB Reserve Card

UOB Reserve Card is a invite only card from UOB Bank of Singapore. You need to have at least S$2 million in your reserves parked with UOB to get an invitation for this card. You can also get a limited edition diamond-embellished card if you charge your UOB Reserve Card for S$1 Million in first membership year. UOB Reserve Card comes with hefty annual fee of S$3,852 including GST.

Apart from unlimited airport lounge access worldwide, this card gives you the ability to purchase unlimited discounted miles from UOB. This card also provides Club Hyatt membership and Hilton Honors Gold membership along with access to some of the prestigious clubs. Supposedly with UOB Reserve Concierge, you can have someone queue for you, book restaurants or reserve tickets at the most popular concerts.

Bottomline

The biggest question is: are these exclusive credit cards worth it? Well it all depends on your lifestyle and aspirations. If you are able to extract value from these cards or your lifestyle matches the spend patterns for these cards, then why not?

Let me know in comments below if you know of any other exclusive credit cards apart from the one mentioned in this article.