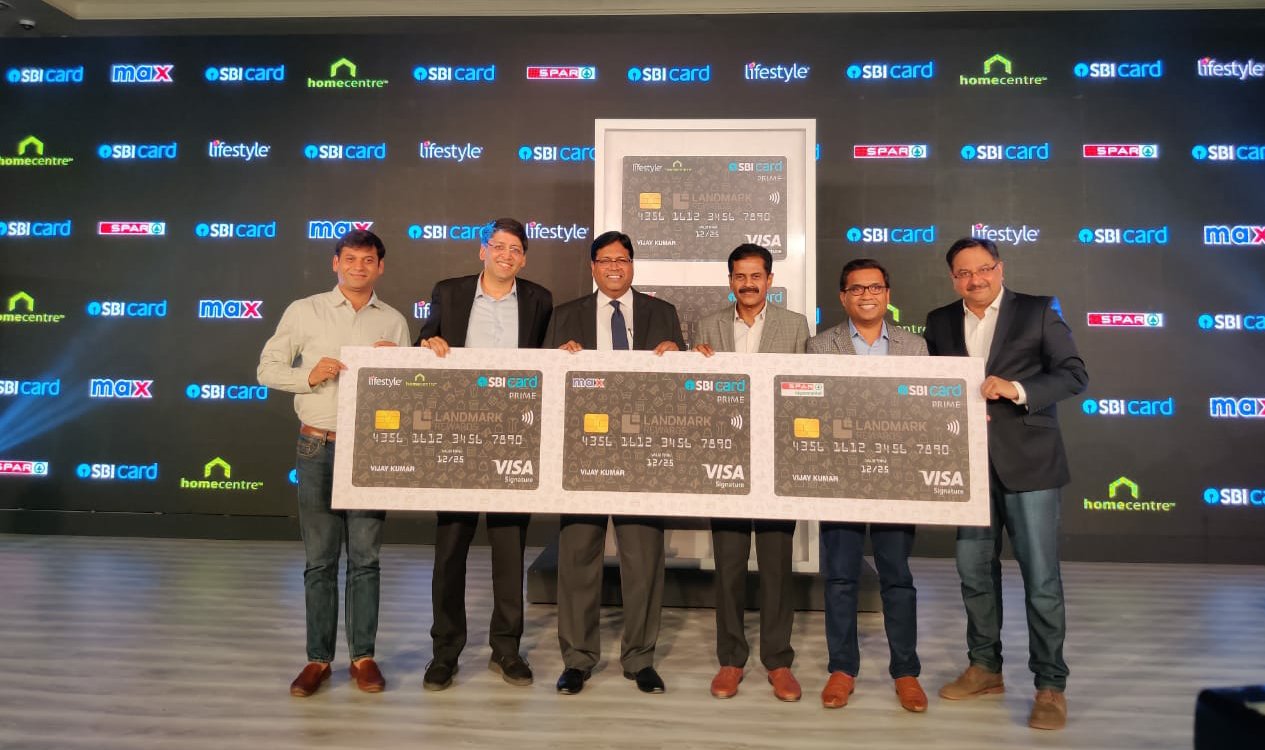

SBI Card launched nine new co-branded credit cards with Landmark Group today. The new cards come in three variants: Prime, Select and Base. Each variant is available for three Landmark Group brands: Lifestyle & Home Centre, Max & Spar.

Landmark Group has ended the partnership with Standard Chartered Credit Cards last month. Launch of a new set of Landmark Group co-branded credit cards was highly speculated. With the launch of these new nine credit cards with SBI Card today, Landmark Group cleared the smoke around it. Let’s look into the features of each variant in detail to see if they are worth it.

Prime

The Prime variant is the top tier credit card and comes with the best reward rate.

- Annual Fee: Rs. 2,999 + GST

- Welcome Benefit: 12,000 bonus reward points equivalent to Rs. 3,000 on realization of annual fee

- Reward Rate:

- 15 Reward Points on every Rs. 100 spent at Online & Retail Landmark Stores (Lifestyle, Home Centre, Max and Spar), 3.75% reward rate

- 10 Reward Points on every Rs. 100 spent at Dining & Movies, 2.5% reward rate

- 2 Reward point per Rs. 100 spent on other retail purchases (Non fuel), 0.5% reward rate

- Milestone Benefits:

- 58,000 cumulative reward points on spending Rs. 1.8 Lakhs on Landmark stores, 8% reward rate

- 20,000 bonus Reward Points on overall annual retail spends of Rs. 5 Lakhs, 1% reward rate

- Airport Lounge Access:

- Domestic: 8 complimentary visits per year, limited to 2 per quarter

- International: 4 complimentary visits per year, limited to 2 per quarter, using Priority Pass

Landmark SBI Card Prime provides a reward rate up to 11.75% on spending Rs. 1.8 Lakhs on Landmark brands which is quite awesome. However if you don’t spend this much on Landmark brands, then the reward rate drops to meagre 0.5% which is a little disappointing. However if you are able to hit the milestone spend of Rs. 5 Lakhs, the reward rate shoots up to decent 1.5%.

Select

The select variant is a notch below the Prime variant and comes with a little lower reward rate.

- Annual Fee: Rs. 1,500 + GST

- Welcome Benefit: 6,000 bonus reward points equivalent to Rs. 1,500 on realization of annual fee

- Reward Rate:

- 10 Reward Points on every Rs. 100 spent at Online & Retail Landmark Stores (Lifestyle, Home Centre, Max and Spar), Dining & Movies, 2.5% reward rate

- 2 Reward point per Rs. 100 spent on other retail purchases (Non fuel), 0.5% reward rate

- Milestone Benefits:

- 34,400 cumulative reward points on spending Rs. 1.5 Lakhs on Landmark stores, 5.7% reward rate

- 12,000 bonus Reward Points on overall annual retail spends of Rs. 3 Lakhs, 1% reward rate

Landmark SBI Card Select provides a reward rate up to 8.2% on spending Rs. 1.5 Lakhs on Landmark brands which is quite decent. Just like the Prime variant, the default reward rate is 0.5% which shoots up to 1.5% on reaching the milestone spend of Rs. 3 Lakhs.

Base

The base variant has the lowest reward rate on Landmark brands and lowest annual fee.

- Annual Fee: Rs. 499 + GST

- Welcome Benefit: 2,000 bonus reward points equivalent to Rs. 500 on realization of annual fee

- Reward Rate:

- 5 Reward Points on every Rs. 100 spent at Online & Retail Landmark Stores (Lifestyle, Home Centre, Max and Spar), Dining & Movies, 1.25% reward rate

- 1 Reward point per Rs. 100 spent on other retail purchases (Non fuel), 0.25% reward rate

- Milestone Benefits:

- 5,000 cumulative reward points on spending Rs. 95,000 on Landmark stores, 4.2% reward rate

- 8,000 bonus Reward Points on overall annual retail spends of Rs. 2 Lakhs, 1% reward rate

Landmark SBI Card provides a reward rate of 5.45% on spending Rs. 95,000 on Landmark brands which is quite decent. The default reward rate is mere 0.25% which is a huge letdown. However if you manage to spend Rs. 2 Lakhs on this card, the reward rate reaches to 1.25%.

Bottomline

I feel SBI Card and Landmark Group went overboard with launching these cards. Nine credit cards would certainly confuse customers. I wish they had launched just 3 variants to keep it simple. Also among these, only Prime and Select variants are worth considering if you spend a lot on Landmark group brands. The base variant has a very low default reward rate and other co-branded credit card, e.g. Flipkart Axis Bank Credit Card, Amazon Pay ICICI Bank Credit Card, Ola Money SBI Credit Card, are better value proposition than this.

Should you go for these cards? Well I wouldn’t recommend these cards unless you are spending a significant amount on Landmark brands.

What do you think of these new nine credit cards from SBI Card and Landmark Group? Are you planning to take one of these? Let me know in comments below.