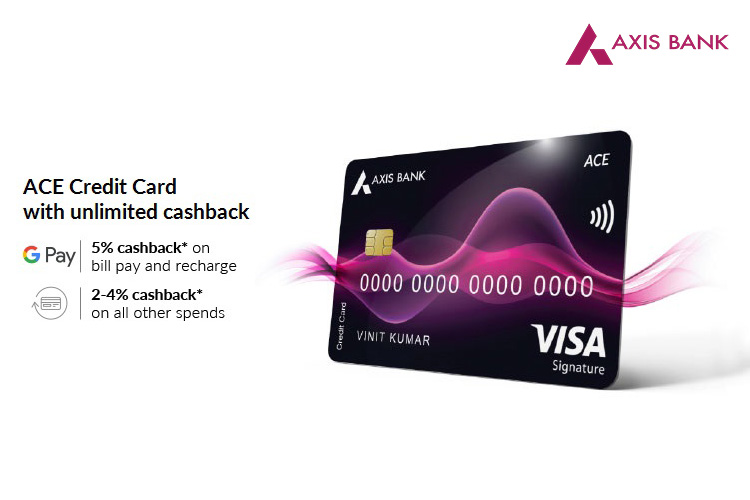

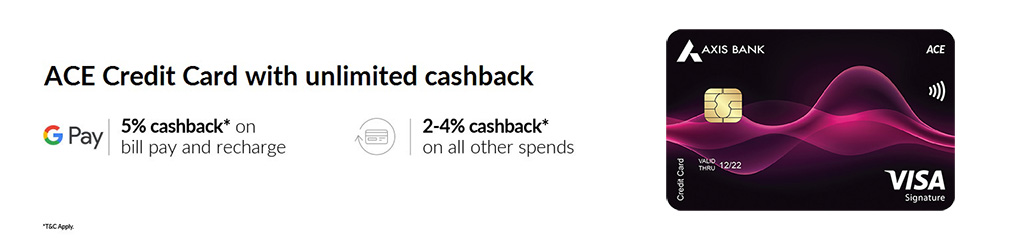

Axis Bank in association with Google Pay launched ACE Credit Card today. Axis Bank ACE Credit Card is an entry level card which provides accelerated rewards on bill pay and recharge at Google Pay. This card provides the reward in the form of cashback making it simple and hassle free.

Axis Bank ACE Credit Card borrows its design from other credit cards launched by Axis Bank in recent times. The card sports a maroon abstract art on a black background. This card is available on Visa platform in Signature tier and is enabled for contactless payments.

Eligibility Criteria

Currently Axis Bank ACE Credit Card is available to only select customers of Google Pay. However one can apply online for this credit card on Axis Bank website too. Click on the button below to apply for Axis Bank ACE Credit Card.

Fees

Axis Bank ACE Credit Card comes with following fees:

- Joining fee: Rs. 499 + GST

- Renewal fee: Rs. 499 + GST

Joining fee is reversed upon spending Rs. 10,000 within 45 days of card setup which seems quite reasonable. Renewal fee is also waived off on achieving an annual spend of Rs. 2 Lakhs.

Features

Launch Offer

Under a limited time launch offer, Axis Bank ACE Credit Card holders can enjoy a 5% cashback on Big Basket and Grofers. This offer is valid till 31st December 2020. There is no mention of minimum order amount and maximum cashback and hence it seems there are no such limits, which is great.

Rewards

- 5% cashback on bill payments via Google Pay. Following categories are covered:

- Electricity

- Internet

- Gas

- DTH

- Mobile Recharge

- 4% cashback on Swiggy, Zomato and Ola

- 2% cashback on all other spends except following:

- Fuel

- Wallet Load

- EMI

Cashback earned for the purchases during a billing cycle will be credited in the next billing cycle 3 days prior to the statement generation date. 5% unlimited cashback on bill payments is really great and there aren’t any cards in the market which provide the same without any cap. The default 2% cashback on other spends is simply amazing and it’s highest among entry level credit cards released so far.

Airport Lounge Access

Axis Bank ACE Credit Card provides 4 complimentary access to domestic lounges per year. Below airport lounges are covered via this card:

| City | Lounge | Terminal |

|---|---|---|

| Delhi | Plaza Premium | T1D, T2 & T3 |

| Bangalore | TFS | Domestic & International |

| Mumbai | MALS | Domestic |

| Mumbai | TFS | Domestic T1C |

| Pune | Bird | Domestic |

| Chennai | TFS | Domestic A & B |

| Hyderabad | Plaza Premium | Domestic & International |

| Kolkata | TFS | Domestic & International |

The list seems decent and most metros are covered.

Other Benefits

- 1% fuel surcharge waiver all transactions between Rs. 400 to Rs. 4,000, maximum up to Rs. 500 per month

- 20% off on partner restaurants participating in Dining Delights Program.

- Convert purchases over Rs. 2,000 to EMI

Drawbacks

Though Axis Bank ACE Credit Card is a fantastic entry level lifestyle credit card, there are some downsides too.

- The spend criteria for waiver of renewal fee is Rs. 2 Lakhs which is on a higher side I believe. I wish Axis Bank should have kept this limit lower.

- There are no joining and renewal benefits in lieu of fees paid, which is a little disappointing.

Verdict

The 5% unlimited cashback on bill payments makes Axis Bank ACE Credit Card really attractive. None of the cards in the market currently provide unlimited cashback on bill payments. This makes this card stand out from the masses.

Also the 2% default reward rate is simply amazing and beats every other entry level credit card in the market right now. If you’re looking for a simple cashback credit card, look no further and go for this card blindly.

What do you think of the new Axis Bank ACE Credit Card? Have you been able to apply for this credit card via Google Pay app? How has been your experience with the application process of this card? Let me know by leaving a quick comment below.