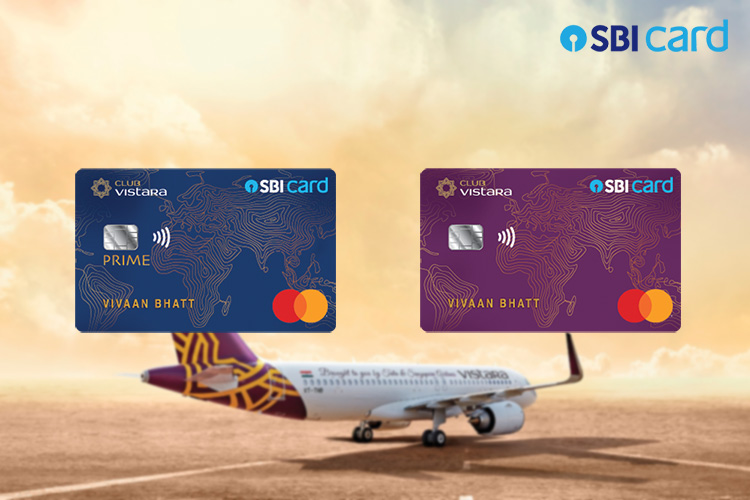

SBI Card in association with Air Vistara launched Club Vistara SBI Card today. The newly launched Club Vistara SBI Card comes in two variants: Regular and Prime. These cards are available on MasterCard platform in World tier and are enabled for contactless payments. The benefits on Club Vistara SBI Cards include but not limited to complimentary flight tickets, hotel vouchers, airport lounge access, free cancellations based on spend milestones.

- TOC

Club Vistara SBI Card (Regular)

Club Vistara SBI Card is regular version of the card with lower joining and annual fees. The rewards offered by this card is lower in comparison to premium version. The card comes in purple color with golden murals to add to it’s aesthetics. Let’s look in to the benefits offered by this card in detail.

Fees

- Joining: Rs. 1,499

- Renewal: Rs. 1,499

Welcome Benefits

- 1 Economy class ticket E-Gift Voucher (base fare waived off) on payment of annual fee

- 1,000 bonus Club Vistara Points on spending Rs. 50,000 within 90 days of card issuance

The joining fee is compensated by economy class ticket voucher which is great.

Reward Points

- 3 Club Vistara points per Rs. 200 spent

Great thing to note here is that fuel spends also accrue reward points.

Milestone Benefits

- 1 Economy class ticket E-Gift Voucher (base fare waived off) each on crossing spends threshold of Rs. 1.25 Lakhs, Rs. 2.5 Lakhs & Rs. 5 Lakhs

- 1 Hotel E-Voucher from Yatra worth Rs. 5,000 on reaching annual spends of Rs. 5 Lakhs

Airport Lounge access

- Domestic: 4 complimentary visits per year, limited to 1 per quarter

- International: Nil

- Complimentary Priority Pass Membership

No international airport lounge access is a big downer for this card.

Insurance Cover

- Lost card liability cover: Rs 1 lakh

- Cancellation (Up to 4 cancellations): Each up to Rs. 3,500

- Baggage Damage Cover: Rs. 2,500

- Air Accident Cover: Rs. 50 Lakhs

- Loss of check in baggage: Rs. 72,000

- Delay of check in baggage: Rs. 7,500

- Loss of travel documents: Rs. 12,500

The insurance cover provided by this card is comprehensive, though the limit is little bit on lower side.

Club Vistara SBI Card PRIME (Premium)

Club Vistara SBI Card PRIME is a premium version of this card with higher fees and better benefits. The design of this card is similar to previous ones and golden murals on blue background looks pleasing to the eyes. Let’s delve in to the details of the benefits offered by this card.

Fees

- Joining: Rs. 2,999

- Renewal: Rs. 2,999

Welcome Benefits

- 1 Premium Economy ticket E-Gift Voucher (base fare waived off) on payment of annual fee

- 3,000 bonus Club Vistara Points on spending Rs. 70,000 within 90 days of card issuance

It’s quite evident that SBI Card compensates for joining fees by providing the premium economy ticket.

Reward Points

- 2 Club Vistara points per Rs. 100 spent

Similar to previous card, spend on fuels also accrue reward points on this card which is great.

Milestone Benefits

- 1 Premium Economy ticket each on annual spends of Rs. 1.5 Lakhs, Rs. 3 Lakhs, Rs. 4.5 Lakhs & Rs. 8 Lakhs

- 1 Hotel E-Voucher from Yatra worth Rs. 10,000 on reaching annual spends of Rs. 8 Lakhs

Airport Lounge access

- Domestic: 8 complimentary visits per year, limited to 2 per quarter

- International: 4 complimentary visits per year, limited to 2 per quarter using Priority Pass

International airport lounge access is a huge plus point for this card. The limit for domestic airport lounge access is also quite decent.

Insurance Cover

- Lost card liability cover: Rs 1 lakh

- Cancellation (Up to 6 cancellations): Each up to Rs. 3,500

- Baggage Damage Cover: Rs. 5,000

- Air Accident Cover: Rs. 1 Cr.

- Loss of check in baggage: Rs. 72,000

- Delay of check in baggage: Rs. 7,500

- Loss of travel documents: Rs. 12,500

Again, the insurance cover provided by this card is comprehensive and limits are better than regular version.

Bottomline

Club Vistara SBI Card is a nice attempt to attract those who like to earn air miles spends on their credit cards. Club Vistara SBI Card PRIME is in same league as Axis Bank Vistara Signature Credit Card fees wise, but former provides way better rewards than latter. It does makes sense to go for Club Vistara SBI Card PRIME instead of Axis Bank Vistara Signature Credit Card.

The hotel voucher benefit on reaching spending milestone is great and comprehensive insurance cover is best in class.

However absence of international airport lounge access on Club Vistara SBI Card is disappointing. Also no complimentary airport lounge access to add-on card member is a huge downer. Inclusion of add-on card members for airport lounge access should have made this card even better. Also the network of Air Vistara is not that great but it’s improving day by day.

Even with these nuances, Club Vistara SBI Card is still a solid product and I would definitely recommend it to someone who is in to miles and points game. I also hope SBI Card soon launches the super premium version of this card, Club Vistara SBI Card ELITE, with benefits like complimentary business class tickets to lure the HNIs. Till then, I am keeping my fingers crossed!

What do you think of the new Club Vistara SBI Cards? Let me know in comments below.