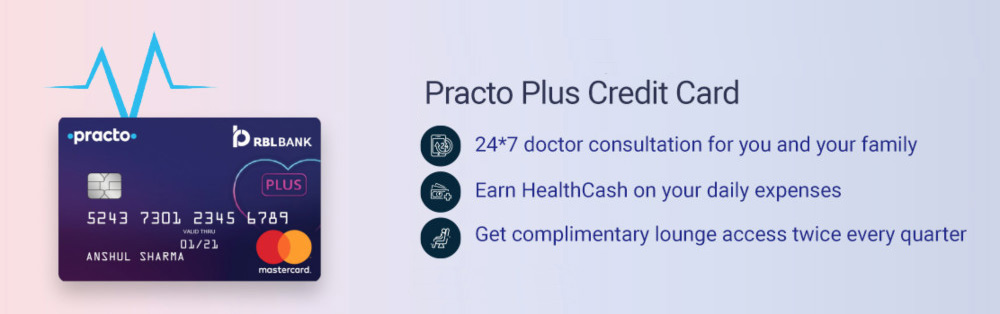

Practo in association with RBL Bank launched first of its kind health focused co-branded credit card, RBL Bank Practo Plus Credit Card, today. This card offers benefits like unlimited online consultations, cashbacks in the form of HealthCash, free health checkups etc. Given the recent launch of co-branded credit cards of Amazon, Paytm, Ola & Flipkart, launch of this card comes as no surprise to me.

Rewards & Benefits

Practo Plus Credit Card offers HealthCash for spends which can be used on Practo app for availing services like ordering medicine, tests, online consultations etc.

Practo Plus Credit Card comes with following benefits:

- Welcome benefits:

- Unlimited online consultations with doctors 24x7 for 1 year

- One free full body health check-up

- 1 Practo HealthCash for every Rs. 100 spent, HealthCash can be used while availing Practo services like ordering medicine, tests, online consultations etc.

- 24x7 family doctor team via Practo Plus membership

Features

Given that this card mainly focuses on health benefits, the features are very limited:

- Complimentary 2 domestic airport lounge access per quarter

Fees

The joining and annual charges for Practo Plus Credit Card are as below:

- Joining Fee: Rs. 2,000

- Renewal Fee: Rs. 2,000

There is no spend best waiver criteria for joining and renewal fee on this card and hence card members have to compulsorily shell out Rs. 2,000 each year.

Eligibility

There is no specific eligibility criteria mentioned for this credit card and it seems it’s open for all individuals with age between 21 to 65 years. Obviously a good credit score and stable monthly income is required for easy approval of the card.

How to apply?

You can apply for Practo Plus Credit Card online on Practo website.

Bottomline

Though the idea is novel, this card doesn’t justify the higher joining and renewal fee compared to other co-branded credit cards that were launched recently. Unavailability of flat cashback, limited option to redeem rewards and only first year benefit of unlimited online consultation makes the card even less attractive. I wish they should have included complimentary quarterly health check-ups, discounts on health club/gym memberships, complimentary health/life insurance along with flat cash back to make it attractive. In it’s current form, I’ll give this card a pass.

What’s your take on Practo Plus Credit Card? Let me know in comments below.