RBL Bank, in a shocking move, devalued the reward points on their credit cards by as high as 32%. This devaluation was done at the start of this month. What is even more shocking is that RBL Bank didn’t inform the cardholders in advance about this. Let’s look into the details to know more.

Devaluation

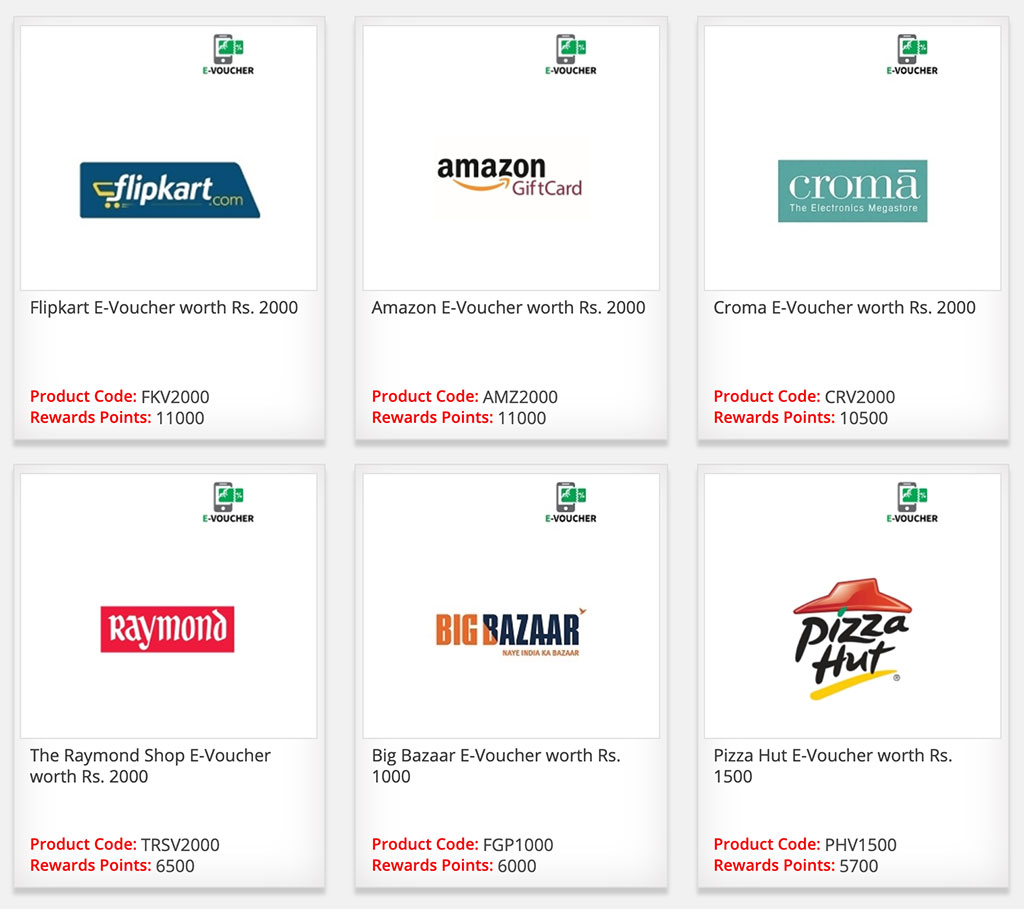

Earlier each reward point of RBL Bank credit card was equivalent to Rs. 0.25 when it was redeemed from their reward portal. However with recent devaluation, the value of one point drops to as low as Rs. 0.17 which is 32% devaluation. Check the image below to see the redemption option available for gift vouchers and corresponding reward points required.

Below table summarizes the devaluation for some popular gift voucher redemption options:

| Gift Voucher | Current value of 1 Reward Point | Devaluation* |

|---|---|---|

| Big Bazaar | 0.17 | 32% |

| Flipkart | 0.18 | 28% |

| Amazon | 0.18 | 28% |

| Croma | 0.19 | 24% | Spencers | 0.19 | 24% |

| Myntra | 0.19 | 24% |

| Central | 0.19 | 24% |

| Lifestyle | 0.19 | 24% |

| Shoppers Stop | 0.19 | 24% |

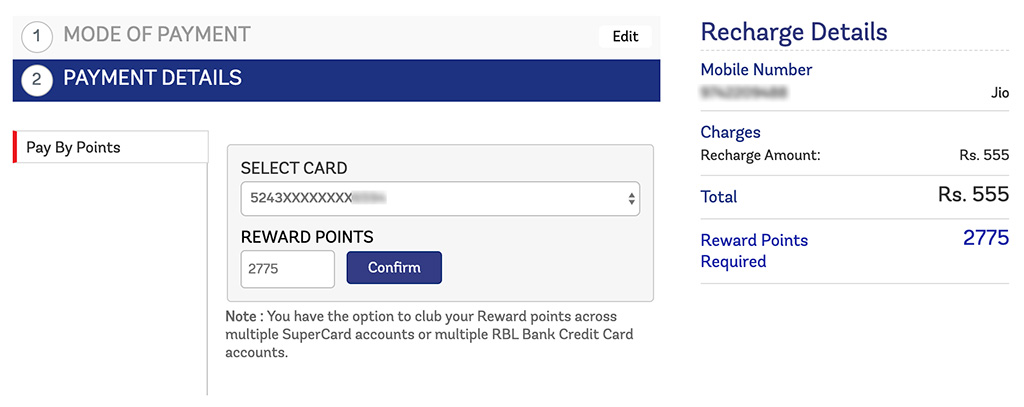

This devaluation has also affected the prepaid mobile recharges. For prepaid mobile recharge, now each reward point is equivalent to Rs. 0.20 which is again a 25% devaluation.

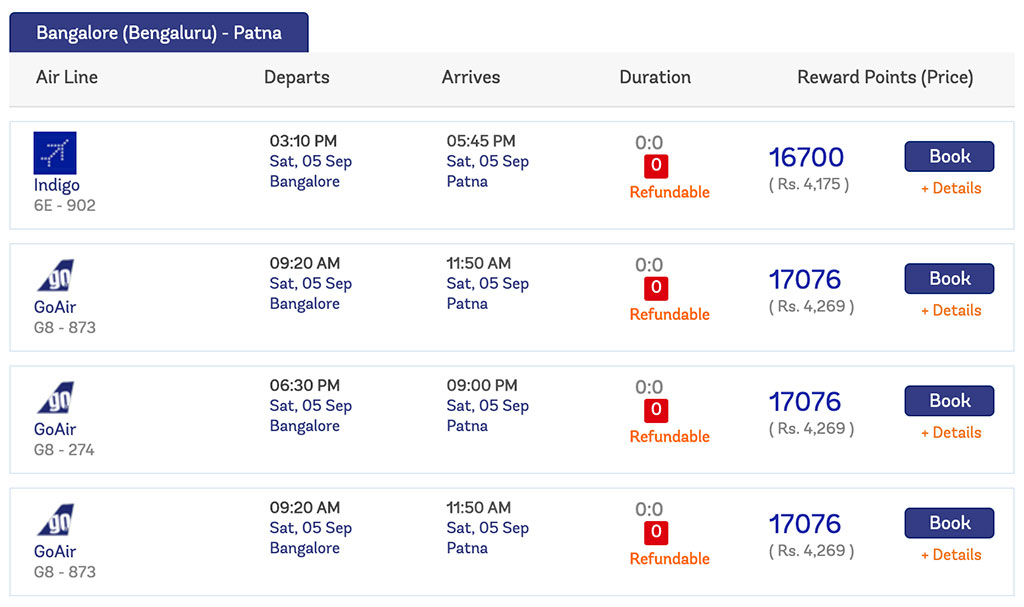

However it seems, travel category has been spared for now where each reward point is still Rs. 0.25 as shown below:

Given that travel is anyways not possible now due to COVID-19 lockdown, this also doesn’t bring any joy.

Bottomline

I heard some chatter about the devaluation on Twitter and when I logged in to the rewards portal to verify, I was shocked to see that it was true. Though it doesn’t impact me much as I hold the RBL Fun Plus Credit Card just for monthly two free movie tickets on BookMyShow. I had a few thousands reward points on this card which I redeemed for prepaid mobile recharge.

However I am really disappointed because RBL Bank has not maintained the transparency by informing customers in advance. Amex, on other hand, informed all customers 3 days in advance about the devaluation which happened earlier this year. I wish RBL Bank should have followed Amex’s path maintaining full transparency.

What do you think of this devaluation by RBL Bank? How are you planning to redeem your reward points? Let me know in comments below.