HDFC Bank launched the Millenia series last year to cater the lifestyle and aspiration of millennials. With this launch, HDFC Bank unveiled HDFC Bank Millennia Debit Card along with credit, prepaid and EMI cards.

HDFC Bank Millennia Debit Card comes with a host of benefits like accelerated cashback on online spends, complimentary airport lounge access, insurance cover and relatively higher ATM withdrawal limits.

In this article I will not only be reviewing HDFC Bank Millennia Debit Card in detail, but will also talk about the in-hand experience with this card. So let’s get started.

HDFC Bank Millennia Debit Card comes with a blue background and minimalistic design. Unlike other debit cards, the card number and expiry date are printed at the back. Though the card looks decent, it lacks the premium feeling. HDFC Bank Millennia Debit Card is available on MasterCard platform in World tier and is enabled for contactless transactions.

Eligibility Criteria

HDFC Bank Millennia Debit Card is available to both resident and non-resident (NRE) account holders. Resident Indians should hold one of the following accounts to get the Millennia Debit Card:

- Savings Account

- Current Account

- SuperSaver Account

- Loan Against Shares Account (LAS)

- Salary Account

- Individual Account Holders (Savings Account, Corporate Salary Accounts & Senior Citizens)

Fees

- Annual Fees: Rs. 500 + GST

HDFC Bank Millenia Debit Card comes with an annual fee of Rs. 500 + GST. However this fee is waived off for Classic, Preferred and Imperia customers.

Features

HDFC Bank Millennia Debit Card comes with multiple features and benefits. Let’s look into each of those in detail.

Cashback

- 5% cashback on shopping via PayZapp and SmartBuy

- 2.5% cashback on all online Spends

- 1% cashback on all offline spends and Wallet reloads

- Cashback is earned in form of Cashback Points where 1 Cashback Point = Rs. 1

- Maximum capping on cashback: Rs. 400 per month

- Minimum transaction: Rs. 400

- Cashback Points needs to be redeemed via NetBanking (NetBanking → Cards → Debit Cards → Enquire → CashBack Enquiry and Redemption → Account Number → Continue → Input the Cashback amount in multiples of 400)

- Cashback Points will be credited in 90 days from the date of transaction

- Cashback Points will be valid for redemption within the next 12 months of accrual

HDFC Bank Millennia Debit Card provides decent cashback. However the lower limit on maximum cashback that can be earned per month is really disappointing. Also the cashback needs to be redeemed via NetBanking explicitly which is a little cumbersome.

Airport Lounge Access

- 4 complimentary domestic airport lounge access per year, limited to 1 per quarter

4 complimentary domestic airport lounge access per year is decent, however the limit of 1 per quarter is a little disappointing. I wish HDFC shouldn’t have put this quarterly restriction.

Insurance Cover

- Personal Accident Death Cover of up to Rs. 10 Lakhs

- International Air Accident Cover of Rs. 1 Crore

- Fire & Burglary Protection of Rs. 2 Lakhs

- Checked Baggage Insurance Sum of Rs. 2 Lakhs

It’s evident that HDFC Bank provides comprehensive cover on this card. However note that debit card should be used on retail or on-line stores at at least once every 30 days to keep the free personal death insurance cover on their debit card active. Also International Air Accident Cover is valid only if air tickets are purchased using the debit card.

Other benefits

- Fuel surcharge waiver at all fuel stations across India

- Higher debit card limits

- Enabled for international transactions

- Zero liability to any fraudulent Point of Sale transactions on the Debit Card, which take place upto 90 days prior to reporting the card loss

Drawbacks

Though the cashback benefits on HDFC Bank Millennia Debit Card are really great, there are some drawbacks too:

-

Lower limit on monthly cashback amount: The monthly cashback limit of Rs. 400 is really low. Also the minimum transaction amount to earn cashback is Rs. 400 which is on the higher side. I wish HDFC Bank should have increased the monthly cashback limit and lowered the minimum transaction amount.

-

No automatic credit of cashback: The cashback points earned on this card explicitly needs to be redeemed via NetBanking which is little cumbersome. I don’t understand the logic of manually redeeming the cashback and I wish HDFC should have credited the cashback to account once the threshold is reached.

Personal Experience

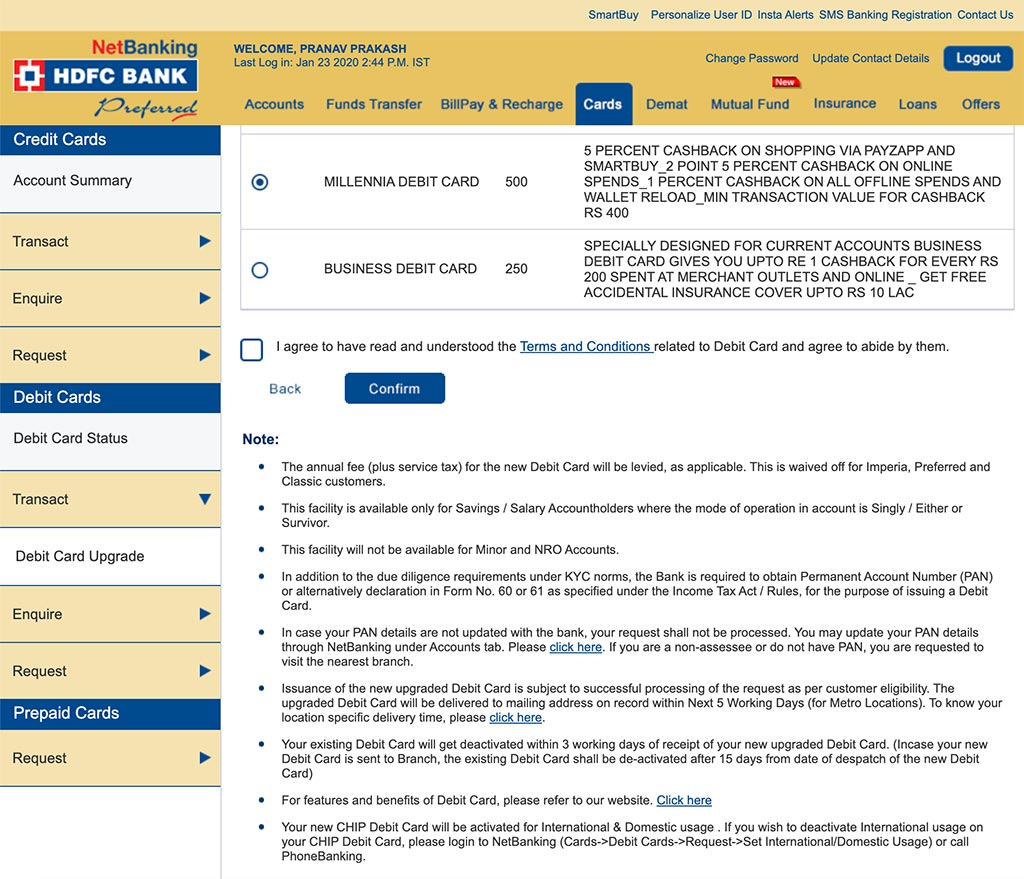

I was holding an HDFC Bank Platinum Debit Card and I was looking for a debit card with a better reward rate. While going through HDFC Bank NetBanking, I found an option to apply for this card online. I navigated to Netbanking → Cards → Debit Cards → Transect → Debit Card Upgrade and applied for upgrade as shown below:

The new debit card was delivered in 3 days to Bangalore via Bluedart and the same day the old debit card was disabled. I was provided the MasterCard World variant of the card. I was able to set the PIN using NetBanking for ATM cash withdrawals.

I made a few transactions via PayZapp in the next few days. I was able to see the cashback points in NetBanking roughly after 90 days of transaction under the “Loyalty Points Millennia Debit Card” section. I redeemed 400 cashback points for Rs. 400 cash and the same was credited to my bank account in 3 days. Overall it was a seamless experience and I liked it.

Verdict

HDFC Bank Millennia Debit Card provides handsome reward rate on online shopping. Other benefits like complimentary lounge access and comprehensive insurance sets this debit card apart from its peers. However the low limit on monthly cashback and hassle of redeeming cashback via NetBanking is a let down. I would highly recommend this debit card if you have Classic, Preferred or Imperia relationship with HDFC Bank.

Which debit card you currently hold from HDFC Bank? Are you planning to upgrade your debit card to Millennia Debit Card? Let me know in comments below.