HDFC Bank, in partnership with Mastercard, launched Millennia series of Credit/Debit/Prepaid/EasyEmi cards today. These entry level cards are targeted towards catering the lifestyles and aspirations of millennials which constitute 34% of India’s population.

Rewards

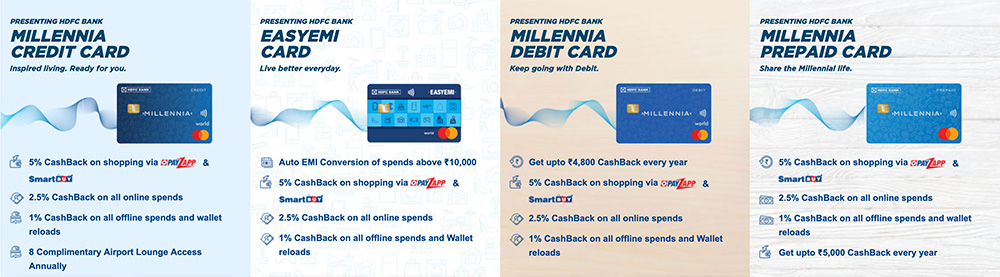

Each of these cards (Credit/Debit/Prepaid/EasyEmi) offer similar reward rate and benefits. All these cards provide accelerated cashback on transacting via PayZapp and SmartBuy along with better cashback on online spends. The different reward rates of Millennia Cards are outlined below:

| Credit Card | Debit Card | Prepaid Card | EasyEmi Card | |

|---|---|---|---|---|

| PayZapp & SmartBuy | 5% | 5% | 5% | 5% |

| Online | 2.5% | 2.5% | 2.5% | 2.5% |

| Offline | 1% | 1% | 1% | 1% |

| Max Cashback | Rs. 750 | Rs. 400 | Rs. 400 | Rs. 750 |

These cashbacks are applicable only on minimum transaction of Rs. 2,000 for online spends and Rs. 100 for offline spends.

Apart from these, HDFC Bank Millennia Credit Card comes with following welcome and milestone benefits:

- Rs. 1,000 worth gift vouchers on spends of Rs. 1,00,000 and above in each calendar quarter for first year

- Welcome Benefit/Renewal Benefit of 1,000 Cash Points (applicable only on payment of membership fee)

- First year’s membership fee waived off if spent more than Rs. 30,000 in the first 90 days

- Renewal membership fee waived off on annual spend of Rs. 1,00,000 in previous year

Features

Given that these are entry level cards, the features are very limited. Some of the notable features of Millennia cards are below:

- Complimentary Domestic Airport Lounge Access

- Credit Card - 8 per year

- Debit Card - 4 per year

- 1% fuel surcharge waiver

Fees

Each of the Millennia Card comes with a joining and annual/renewal fee.

- Millennia Credit Card - Rs. 1,000 + GST joining & renewal fee

- Millennia Debit Card - Rs. 500 + GST annual fee

- Millennia Prepaid Card - Rs. 499 + GST issuance & annual maintenance fee

- EasyEMI Card - Rs. 1,000 + GST joining & renewal fee

How to apply?

You can apply for Credit, Prepaid and EasyEMI card online by filling below form on HDFC Bank website:

For debit card, you can replace your existing one with Millennia version by submitting a request in internet banking.

Bottomline

HDFC Bank Millennia Cards are entry level lifestyle cards suitable for beginners. The accelerated reward rate for online spends is quite decent and offline reward rate is also comparable to other recently launched co-branded credit cards. However low monthly cap for cashback on Millennia cards is really disappointing as recently launched co-branded credit cards don’t have such limit.

It doesn’t make any sense to go for these cards if you are holding Regalia, Diners ClubMiles, Diners Black and Infinia as these cards provide better default reward rate and access to international airport lounges. However if you’re holding other entry level cards from HDFC, you should definitely consider upgrading to Millennia Credit Card.

PS: Check out the in-depth review of HDFC Bank Millennia Credit Card here.