CIBIL updated their Scoring Algorithm in March 2020 to incorporate new data points and trends to make it more comprehensive. This will also enhance the score’s ability to predict the probability of default on loans, a consumer’s credit-worthiness and his/her likelihood of repaying a loan.

What is CIBIL Score?

In this article I am going to articulate the changes to the scoring algorithm which CIBIL has made in March 2020, its impact on loan and credit eligibility and my personal experience. So without further ado, let’s get started.

Changes

CIBIL Score still ranges between 300 and 900, however the underlying algorithm, which used to calculate it, has changed. Due to this, the numeric value which is generated now may be different from the older one. Below table highlights the main changes to the scoring algorithm:

| New CIBIL Score | Old CIBIL Score |

|---|---|

| Based on 36 months of credit history | Based on only 24 months of credit history |

| Available for consumers with less than 6 months of credit history as well | Available for consumers who have at-least 6 month of credit history |

Apart from changes above, following new data points have been included to calculate the new CIBIL Score:

- Depth of credit (i.e. the duration of your existing credit history as calculated from the date when your oldest credit account was opened)

- Long term trend of outstanding balances

- Transaction history on credit cards

- Ratio of actual repayment amount to total amount due

- Number of new accounts opened and number of accounts closed

It’s quite evident that usage of credit cards will play a major role in influencing the CIBIL Score going forward. Out of these five new parameters, four are majorly related to credit cards.

Impact

With the new scoring algorithm, the CIBIL Score has dropped for most of the personnels. However some did report that their CIBIL Score has improved, but the numbers are small.

CIBIL clarifies that even though the score has dropped, it doesn’t mean deterioration in credit profile. This shouldn’t lead to any change in the way lenders’ view your credit application.

However, as per my past experience, banks and financial institutions take a considerable amount of time to update their policies and systems. Hence they might not re-calibrate their policies and systems immediately which might lead to rejection of your credit application due to a sudden drop in CIBIL Score. I believe the situation will improve with time as banks and financial institutions gradually migrate to a new scoring algorithm.

Personal Experience

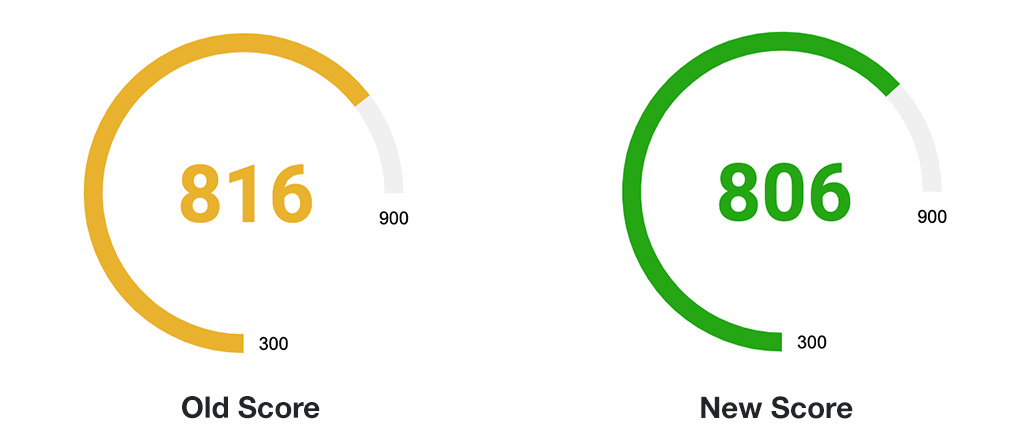

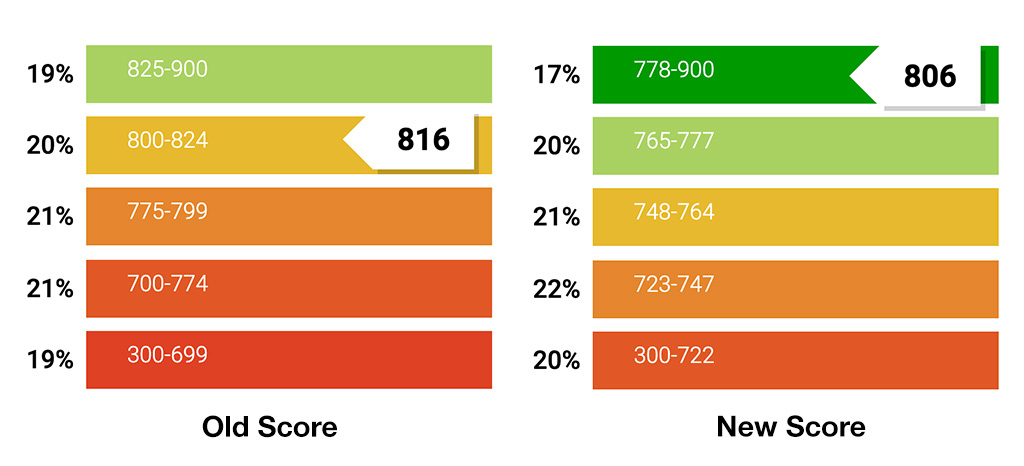

Personally, my CIBIL Score took a hit of 10 points due to this scoring algorithm update. My CIBIL Score was constant at 816 for the past three years and it dropped to 806 with this update.

However it’s not as bad as it looks and if look closely, my segmentation has, in-fact, improved.

Earlier I used to be in top 19% to 39%, but now, with this scoring algorithm update, I am in top 17%. I have been bumped up to the topmost tier which is great.

I believe my CIBIL score remained 800+, even though I have a huge number of credit cards, because I have always paid all my credit card bills in full and there have been very few enquiries in the past three years for credit. Also, I believe, continuous repayment of home loan without any missing EMIs has played a major role in this.

Bottomline

With this scoring algorithm update of CIBIL, responsible usage of credit cards has become even more important. The new parameters which are included to calculate the CIBIL Score mostly pertain to Credit Cards. Hence make sure you don’t apply for too many credit cards in a short span of time and make sure to settle the full credit card bill every month.

Also, this update is a good news for beginners as they don’t have to wait for six months for their CIBIL Score. It would be available sooner than that which will help them in getting more credit, if required.

Temporarily, there would be an increase in the number of rejections for credit. But eventually, it will stabilize once all banks and financial institutions fully migrate to the new scoring algorithm.

You can check your new refreshed CIBIL score for free by enrolling on CIBIL website.

Have you checked your CIBIL Score after the scoring algorithm update? Has your CIBIL Score increased or decreased? Let me know by leaving a quick comment below.