NiYO Global Card is a next generation forex card which eliminates the many pain points of current generation forex cards. To start with, it’s an INR card, which can be used globally (150+ countries), including India and can be loaded via any bank account using IMPS/NEFT/UPI without any charges. The card comes with a companion NiYO Global app which lets you manage your card on the move and offers a bunch of other useful features.

In this review, I am going to outline the features of this card along with my personal experience of using this card in recent EuroTrip. So without further ado, let’s get started.

Features

NiYO Global Card offers a bunch of features which are outlined below:

- Load via IMPS/NEFT/UPI without any charges

- Use it in 150+ currencies with zero forex markup fee

- Use at merchant POS terminals worldwide accepting VISA

- Use it for online transactions in 150+ currencies

- Withdraw cash at ATMs all over world

- Unused money can be transferred back to bank account

- Track expenses realtime using NiYO Global App

- Lock/unlock card on the move using NiYO Global App

- Reset PIN instantly using NiYO Global App

- 24/7 Whatsapp priority service

Ability to use NiYO Global Card in 150+ currencies makes it really versatile. The companion app is really intuitive and user friendly. You can seamlessly lock/unlock card using the app. You can also enable/disable online transactions, merchant (POS) swipes and ATM withdrawals from within the app. The 24/7 Whatsapp service really comes in handy when your phone is not operational in foreign.

Charges

- No joining and renewal fees, currently being issued for free

- No charges for loading the card, however your bank may charge for IMPS/NEFT

- No foreign currency markup fee and Visa exchange rate are applicable for foreign currency transactions

- No ATM withdrawal fee, however the bank that the ATM belongs to, might have their own fees associated with withdrawals

The best thing about NiYO card is that there are no charges at all. They don’t have any joining and renewal fees currently. There are no charges for loading the currency and ATM withdrawal. NiYO doesn’t even charge foreign currency markup fees which other credit cards charge and is in tune of 3.5% + GST. Hence, by using NiYO Global Card, you are straight away saving 4.13% on foreign currency markup fees. NiYO uses Visa exchange rate during settlement which is best in the industry.

What is Visa Exchange Rate?

However one may ask how they are earning money then? Well they earn from the Merchant Discount Rate (MDR). MDR is a fee charged by card issuers to merchants for accepting credit and debit cards. MDR is fully borne by merchants and there is no impact on customers.

Spending Limits

NiYO Global Card comes with following spending limits:

| Category | Per Transaction | Daily | Monthly | Yearly |

|---|---|---|---|---|

| Credit/Top Up | Rs. 10,00,000 | Rs. 10,00,000 | Rs. 10,00,000 | Rs. 25,00,000 |

| Merchant (POS) Swipe | Rs. 5,00,000 | Rs. 10,00,000 | Rs. 10,00,000 | Rs. 25,00,000 |

| Online Transactions | Rs. 5,00,000 | Rs. 10,00,000 | Rs. 10,00,000 | Rs. 25,00,000 |

| ATM | Rs. 1,00,000 | Rs. 1,00,000 | Rs. 2,00,000 | Rs. 5,00,000 |

| Fund Transfer | Rs. 2,00,000 | Rs. 5,00,000 | As per Balance | As per Balance |

I feel these spending limits are pretty generous and will suffice most of the travelers.

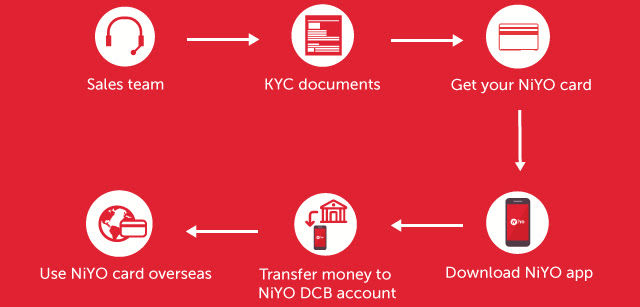

How to get this card?

This card is currently being issued to Indian Citizens holding a valid PAN card and address proof (Aadhaar, Passport etc.).

You can apply online for this card using my referral link below:

Using the above link, both of us will get Rs. 500 on doing the first international POS transaction of Rs. 1,000, which is not available otherwise. Once you fill up the form, you will be contacted by their executive for fixing an appointment. Their executive will visit your place to scan the documents using their mobile app. Hence you need to keep the original documents with yourself during the appointment. Once document collection is done, executive will handover you the card kit which contains following:

- NiYO Global Card

- ATM Pin

- Welcome letter

- Most important terms and conditions

You should be able to login to NiYO Global app post KYC approval and card activation which happens the same day in the night. Post that you can transfer funds to your card using Account Number and IFSC code displayed in the app.

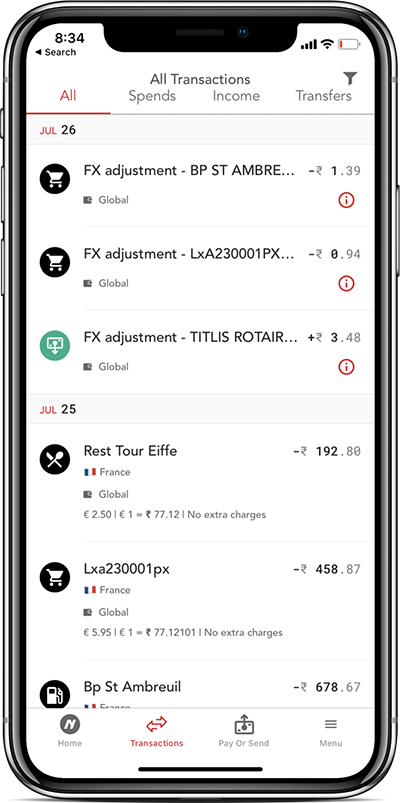

Experience

I used this card extensively in Europe and England and I didn’t face any issue. Loading money was hassle free and I just used to IMPS the amount to the card account and it used to get credit instantly. The card was accepted by all merchants across Europe and England without any glitches. As soon as the transaction was done, it showed up in the NiYO Global app with an amount in both foreign currency as well as approximate INR. The transactions used to get settled in 2-3 days and hence the exchange rate of that time was applicable. Hence, due to fluctuation in currency exchange rates, there used to be some debit or credit of amount.

I also used it for withdrawing money in ATMs and it worked seamlessly. There were no extra charges for ATM cash withdrawals and I was able to get Visa exchange rates for this too.

Verdict

This is a fantastic card which simplifies the forex transactions to a great extent. Given that company is not charging anything for this card, I don’t see a reason for not using this card. Ability to transfer excess funds back to your bank account is cherry on the top.

PS: You can save even more using a combination of NiYO Global Card and credit card. Read about most rewarding credit cards with low forex markup fee for foreign travel & spends here.

What do you think of this card? Share your experience of using this card in comments below.