CIBIL is the most popular credit bureau in India. Most banks check for CIBIL score to know the credit worthiness of an individual. So whenever you go for a loan and credit card, there is a high chance that banks will check your CIBIL Score. It necessitates the periodic check of CIBIL Report to make sure that CIBIL score is healthy.

Currently CIBIL charges around Rs. 1,200 per year for unlimited access to CIBIL Report. Most people think that this is on the higher side and don’t subscribe to it. However there are multiple ways you can check your CIBIL score for free. In this article I am going to list down some of the ways you can access your CIBIL score for free without shelling out any money. So let’s dive right in!

CIBIL Website

As per RBI regulation, every credit bureau is supposed to provide a free credit report to each individual on request, annually. The regulation also dictates that the report should be in electronic format and contents of the report should be the same as appearing in the most detailed version of the reports on the individual provided to credit institutions, including the credit score.

Abiding by this regulation, CIBIL also makes the credit report available to individuals, who have a credit history, every year for free. To access the free CIBIL Score, follow the instructions below:

- Visit CIBIL website and register for a new account.

- Fill in the requested details, ID Type and ID Number is most important as this is the identifier used to pull up the record. I would suggest using the PAN number here.

- On the next screen, fill in the OTP message received on your mobile.

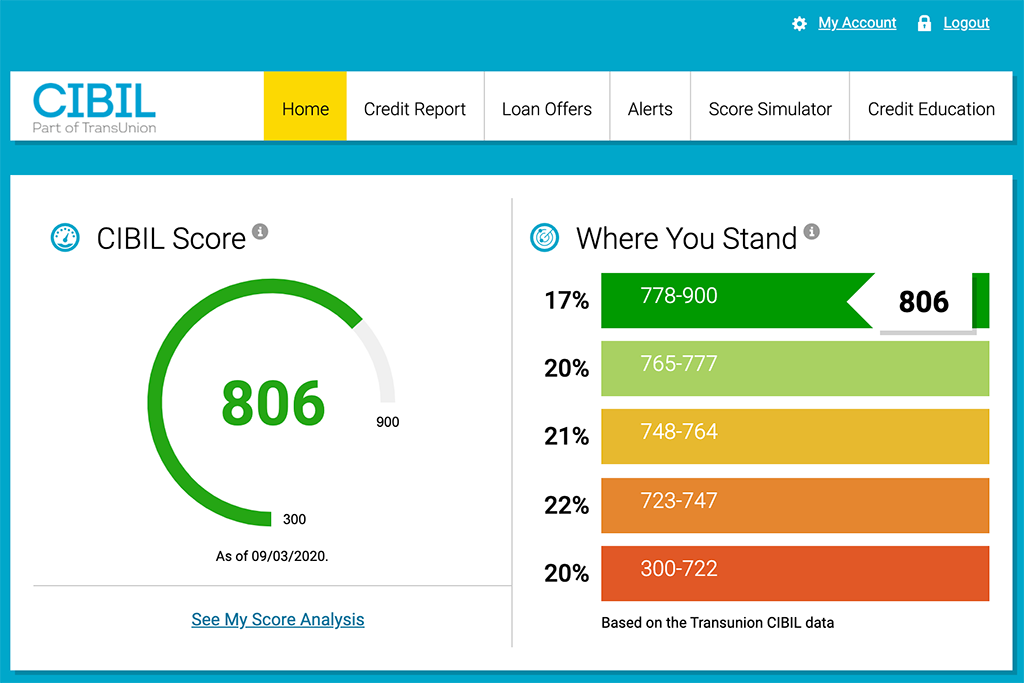

- Post entering the OTP, you will land on Dashboard where you would be presented with your current CIBIL Score and where do you stand as shown below:

- Click on the “Credit Report” tab to access the detailed report.

Below video will help you in interpreting the report.

You can refresh your CIBIL Score and Report once in a year. If you want to get the updated score, you need to opt for the paid subscription.

Banks

Some banks like HDFC and ICICI Bank make the CIBIL Score available to their customers for free. Let’s look into the details to know more.

HDFC Bank

HDFC Bank has made the CIBIL Score available to all it’s customers for free. Follow the steps below to access the free report if you’re an HDFC Bank customer:

- Visit the CIBIL website exclusively created for HDFC Bank customers and register for a new account.

- Fill in the requested details, ID Type and ID Number is most important as this is the identifier used to pull up the record. I would suggest using the PAN number here.

- On the next screen, fill in the OTP message received on your mobile.

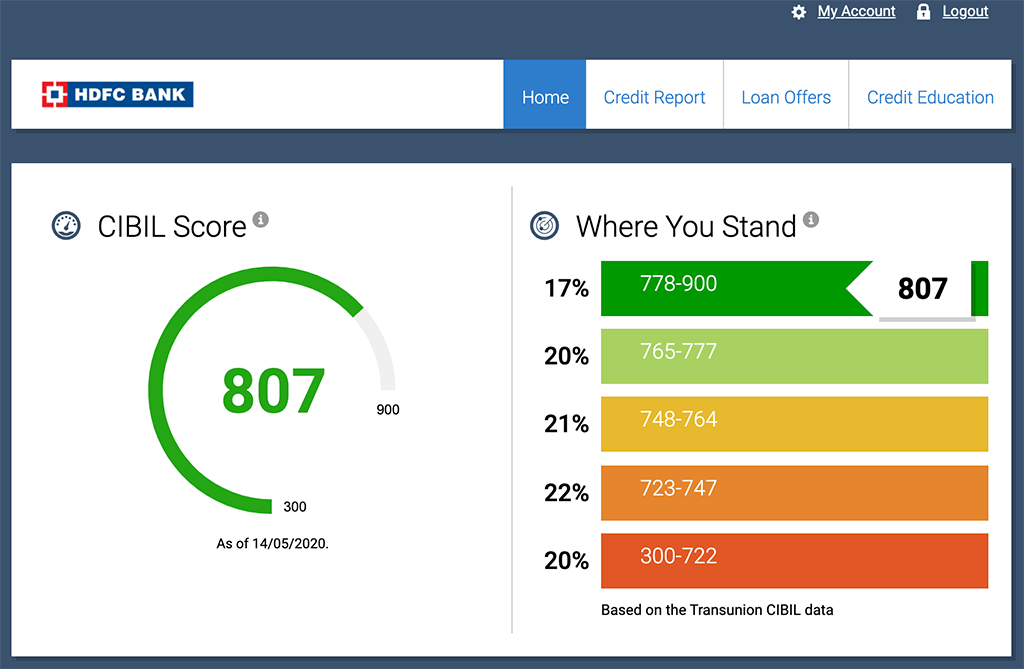

- Post entering the OTP, you will land on Dashboard where you would be presented with your current CIBIL Score and where do you stand as shown below:

- Click on the “Credit Report” tab to access the detailed report.

The main advantage of accessing CIBIL Report this way is that you should be able to refresh your score every quarter. I believe reviewing a credit report once in a quarter is sufficient for most folks.

ICICI Bank

If you hold a wealth management account from ICICI Bank, you can access the CIBIL Score free.

To get the free score from ICICI Bank, follow the instructions below:

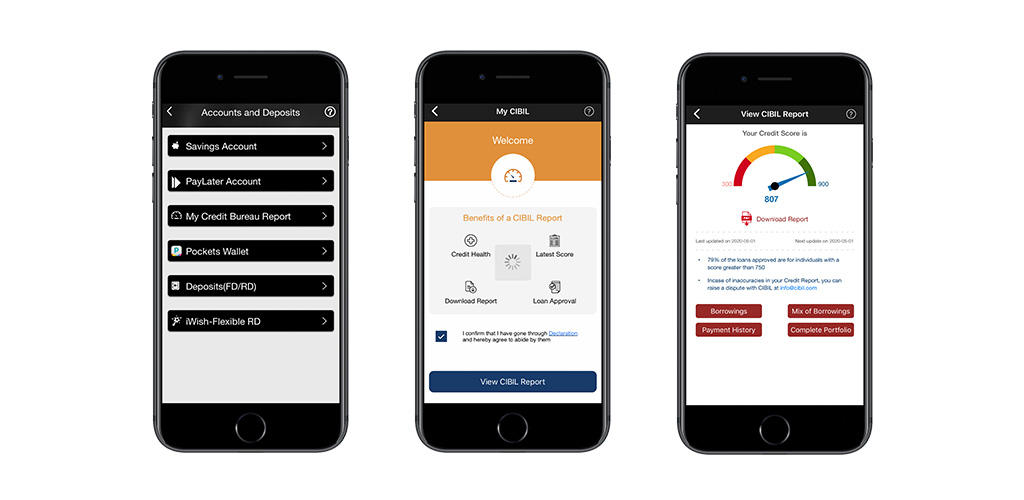

- Click on the “Accounts & Deposits” tile on the home screen of the app.

- Tap on “My Credit Bureau Report”.

- Tap on “View CIBIL Report”.

The best part is you can refresh your CIBIL score once in 15 days. If you use mobile app and internet banking, then you get two refreshes every 15 days separately. It means you can refresh your score for free four times in a month which is amazing.

ICICI Bank has made this available for free only to wealth management account holders which is a little disappointing. To get a wealth management account, you need to maintain a Deposit and Investment Value (DIV) of minimum Rs 25 Lakhs.

Third party Apps and Websites

Many third party apps and websites make the CIBIL as well as other credit bureau reports available for free. However the only catch is you will start getting multiple marketing calls for cross selling their products like personal loan, home loan, credit cards. This is really annoying and hence I would suggest to go this way only if you have exhausted all your options.

PayTM

PayTM has enabled the feature of viewing CIBIL Score for free in their mobile app since quite some time.

To access the free CIBIL Report from PayTM, follow the steps below:

- Login to PayTM mobile app and tap on top right corner to open the menu.

- Now tap on the “My Credit Score” option.

- Enter your Name, Phone Number and PAN Card details to fetch the score.

- Enter the OTP received on your mobile.

Post entering the OTP, you would be presented with CIBIL Score as well as the detailed report. One interesting data point it shows is your relative standing amongst other PayTM users in your city, state and country along with average score. It also gives you other insights like credit utilization ratio, payment history, age of accounts and total number of accounts which impact your credit score.

PaisaBazaar

Keep PaisaBazaar as the last option as they will bombard you with marketing calls and SMSs to cross sell their products. It becomes really annoying after some time and if you think you can deal with these, then go for it.

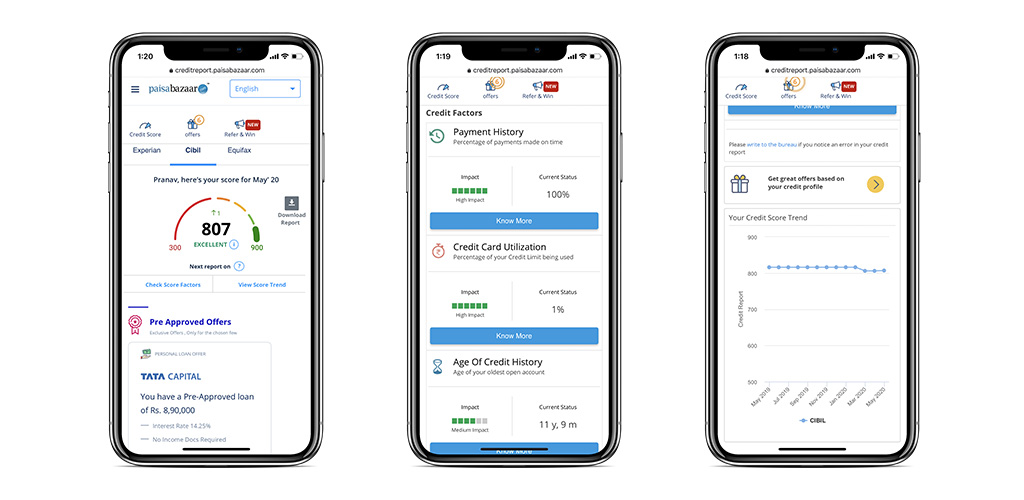

Process to obtain a free credit report from PaisaBazaar is pretty simple. You just have to register on their site by validating OTP. Post registration, just login to their portal and you will be presented with credit scores from many credit bureaus like CIBIL, Experian, Equifax and CRIF.

One advantage of using PaisaBazzar is that you can track the credit scores across multiple credit bureaus at one place. Also it provides you insight into the historical trend of credit score for each credit bureau. The score is refreshed monthly which should be sufficient for the majority of the folks.

FAQs

Will my CIBIL Score reduce after I access through any of the methods above?

What is a good CIBIL Score in India?

What should I do if I see some loans and credit cards in my CIBIL report which I don't recognize?

Why different Credit Bureaus have different credit score for me?

Bottomline

Keeping a tab on CIBIL Score has become extremely crucial now as financial institutions have started to rely more and more on it. A good CIBIL score can get you a lower interest rate on loan, upgraded credit cards, higher limits on credit cards etc. I would suggest reviewing the CIBIL report at least once in a quarter to ensure a healthy credit score.

How often do you check your CIBIL Score? Do you know of any other medium through which CIBIL Report can be accessed for free? Let me know by leaving a comment below.