HDFC Bank in partnership with IndiGo Airlines launched the Ka-Ching Credit Card today. Ka-Ching Credit Card is powered by MasterCard and comes in two variants: 6E Rewards and 6E Rewards XL. While this credit card promises a return of 2.5-5% on spends at IndiGo, the base reward rate ranges from 1%-2%.

IndiGo Airlines also introduced the 6E Rewards program as part of the launch event. 6E Rewards Program is owned, managed and operated by IndiGo wherein Ka-Ching card members can earn rewards using their credit card on IndiGo and other merchants and redeem the rewards for 6E Rewards’ Benefits.

Let’s dive right into the details to know what HDFC Bank Ka-Ching Credit Card has to offer.

- HDFC Bank Ka-Ching 6E Rewards Credit Card

- HDFC Bank Ka-Ching 6E Rewards XL Credit Card

- 6E Rewards Program

- Bottomline

HDFC Bank Ka-Ching 6E Rewards Credit Card

HDFC Bank Ka-Ching 6E Rewards Credit Card is the base variant of the card which comes with a lower annual fees and relatively lower reward rate.

- Annual Fee: Rs. 700 + GST

- Eligibility:

- Age: 21 years to 60 Years

- Income:

- Salaried: Net Monthly Income >= Rs. 20,000

- Self Employed: ITR > Rs. 6 Lakhs per annum

- Welcome Benefit:

- Complimentary IndiGo air ticket worth Rs. 1,500

- Complimentary usage of 6E Prime (priority check-in, choice of seat and a meal)

- Reward Rate:

- 2.5% 6E Rewards on IndiGo website

- 2% 6E Rewards on entertainment, dining and grocery

- 1% 6E Rewards on all other transactions

- Other Benefits:

- Discounted convenience fee of INR 100 per pax per sector

- 1% fuel surcharge waiver

- 5% 6E Rewards on 6E Treats

- 6% 6E Rewards on AVA (IndiGo Airport Merchandize Partner)

- 7% 6E Rewards on Avis

- 10% 6E Rewards on BeU Salon

- 6% 6E Rewards on NetMeds

HDFC Bank Ka-Ching 6E Rewards Credit Card provides a decent default reward rate of 1% on all spends. However note that these rewards can only be used for purchases at IndiGo.

HDFC Bank Ka-Ching 6E Rewards XL Credit Card

HDFC Bank Ka-Ching 6E Rewards XL Credit Card is the premium variant of the card which comes with a higher annual fees and relatively higher reward rate.

- Annual Fee: Rs. 2,500 + GST

- Eligibility:

- Age: 21 years to 60 Years

- Income:

- Salaried: Net Monthly Income >= Rs. 1,20,000

- Self Employed: ITR > Rs. 14.4 Lakhs per annum

- Welcome Benefit:

- Complimentary IndiGo air ticket worth Rs. 3.000

- Complimentary usage of 6E Prime (priority check-in, choice of seat and a meal)

- Reward Rate:

- 5% 6E Rewards on IndiGo website

- 3% 6E Rewards on entertainment, dining and grocery

- 2% 6E Rewards on all other transactions

- Airport Lounge Access: 8 complimentary lounge access per calendar year (twice in a quarter) through Mastercard Lounge program.

- Other Benefits:

- Discounted convenience fee of INR 100 per pax per sector

- 1% fuel surcharge waiver

- 7% 6E Rewards on 6E Treats

- 10% 6E Rewards on AVA (IndiGo Airport Merchandize Partner)

- 10% 6E Rewards on Avis

- 15% 6E Rewards on BeU Salon

- 8% 6E Rewards on NetMeds

HDFC Bank Ka-Ching 6E Rewards XL Credit Card provides splendid reward on entertainment, dining and grocery. The default reward rate of 2% on all other spends is also decent.

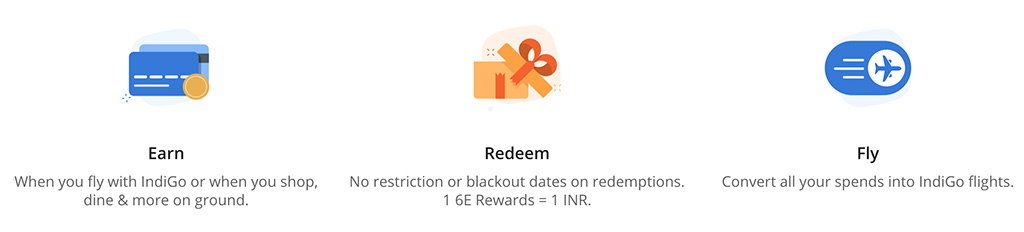

6E Rewards Program

6E Rewards Program is not a frequent flier program, but is a rewards program connected to Ka-Ching Credit Cards. Members can redeem the 6E Rewards for 6E Rewards’ Benefits which include IndiGo flights. 6E Rewards can be redeemed by members online, by logging into their Membership Account. 6E Rewards will be accrued for a minimum transaction of Rs. 100. The rewards are valid for 24 months from the date of accrual on a ‘first in first out basis’. For flight booking, there is a reward redemption fee of Rs. 100 + GST per pax.

Bottomline

Ka-Ching Credit Card series from HDFC Bank are decent credit cards. Given that IndiGo has the best domestic connectivity in India, possessing a co-branded credit card from them makes sense for most of us. However this credit card is invite only as of now and IndiGo will be inviting their customers for the same. I anticipate a gradual rollout to everyone by the end of next quarter.

IndiGo could have done better by rolling out a full fledged frequent flyer program instead of a reward program. With the recent sunset of Jet Airways, IndiGo has a huge opportunity to capture the market. They should act sooner as Vistara is slowly and steadily catching up and their fantastic Club Vistara frequent flyer program has become favorite of many frequent travelers.

What do you think of HDFC Bank Ka-Ching Credit Cards? Given a chance, would you opt for these credit cards? Let me know by leaving a quick comment below.