CRED launched an instant personal credit line, CRED Stash, today. CRED Stash is a digital lending platform which makes a personal credit line available to users in a completely online manner. It does away with the tedious application and verification process that generally accompany personal loans and turns the entire process into an instant and seamless one.

What is a Personal Credit Line?

CRED Stash tries to ease out the cash crunch caused by COVID-19 lockdown. Many individuals have lost the regular cash flow due to this. CRED Stash comes at the right time to rescue them from this situation using its seamless and instant online only process.

In this article I am going to articulate the process for activating the service, its benefits and a review. So let’s get started.

CRED has tied up with IDFC First Bank as their lending partner for CRED Stash. CRED Stash is economical and more flexible than Credit Card EMI options such as Balance Transfer, Convert Transaction to EMI, Outstanding Balance to EMI, Personal Loan on Credit Card etc. These options generally start from 15-16% and majority of the users get interest rates of 19-22%. With CRED Stash, users can avail interest rates in the range of 11-14% which makes it a relatively better choice.

Process

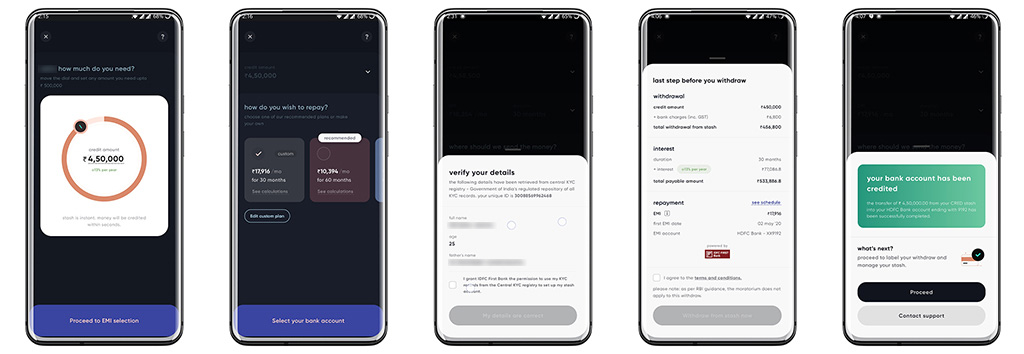

Getting money from CRED Stash to your bank account is a really seamless and online only process. You can choose an amount, within your approved limit, you wish to withdraw from Stash to your bank account and opt for one of the recommended EMI schedules. You can also create your own EMI schedule as per your convenience by changing the period. After this you need to enter the bank details where you would like the money to be transferred.

Post this, your data would be fetched from Central KYC (CKYC) Registry. CKYC registry which is a centralized repository of KYC records thus practically eliminating the lengthy registration process. After the verification of details, you need to set up auto-pay.

Timely repayments are incredibly important for loans and to safeguard its members from the risks to their credit score, CRED has rolled out the feature of auto-pay for its users. Auto-pay automatically pays the amount decided by the user on the chosen date of the month thus eliminating all risks and helps members maintain a healthy credit score.

Once auto-pay is setup, all details pertaining to the amount withdrawn are shown to you including total interest charges and the total repayment amount. On confirming the same, the money is instantly transferred to your chosen bank account.

Overall the process is quite quick and experience is incredibly seamless. I am impressed with the way CRED has simplified the whole user experience making it pleasant for end users.

Benefits

CRED Stash is an instant and pre-approved credit line which can come in handy during unforeseen circumstances where you’re in dire need to cash or want to fund big purchases or travel plans. It provides multiple benefits as articulated below:

-

CRED Stash has no subscription or activation charges and is available to selected CRED users for free. The one time registration shows you your available credit limit and you can withdraw money as many times as you want within that limit.

-

Once opted, the money is transferred to your bank account almost instantly. This is really helpful in the case where you’re in dire need of money.

-

You can create your own EMI schedule which is convenient for you. You can even make the payments beforehand and foreclose the loan without any extra charges. This makes CRED Stash one of the most flexible personal loan services available at the moment.

-

And the best part, the interest rate charged is almost one-third of other unsecured loans like Credit Cards. This preferential interest rate is available to CRED users as they have a high credit score (>750). CRED doesn’t allow users with bad credit scores to register on their platform at all. Owing to lower interest rates, you end up saving a significant amount if you opt for CRED Stash instead of revolving credit on Credit Cards.

Charges

- Registration/Subscription Charges: Nil

There is no registration or subscription charge for CRED Stash and it’s available to selected CRED users for free and is being rolled out to all users gradually. However the bank charges interest on money borrowed which can be seen in the app while availing the loan.

Eligibility

CRED Stash is exclusively available for CRED users only. Since CRED doesn’t allow you to register on their platform if your credit score is below 750, a good credit score automatically becomes a prerequisite to avail this service. Currently CRED Stash is being rolled out in phased manner to CRED users and would be made available to all users over the next couple of weeks.

Verdict

CRED Stash introduces you to one of the most flexible personal credit lines available in India at the moment with significantly lower interest rates. If you’re planning to avail benefit of moratorium on Credit Card bill payments announced by RBI due to cash crunch, I would suggest to opt for CRED Stash instead. If you opt for the former, you will end up paying late payment fees as well as an interest rate as high as 41.88%. At the same time, using CRED Stash personal credit line, you can avail loan with almost one-third interest rate.

As usual, CRED has nailed down the experience for Stash similar to RentPay. Making the entire process online, instant and seamless, CRED has addressed almost all the major issues with traditional personal loan regime. I would highly recommend CRED Stash if you’re looking for a short term personal loan with flexible repayment options.

Don’t have CRED? Get it now to claim your exclusive rewards and benefits from link below:

What are your thoughts on CRED Stash? How does CRED Stash fares in the market against its peers? Let me know your views by leaving a quick comment below.