Bank of Baroda (BoB) Premier Credit Card is a lifestyle credit card from Bank of Baroda. This credit card provides 5X rewards on travel, dining and foreign spends. Apart from accelerated rewards, this card also provides complimentary access to domestic airport lounges and insurance cover.

Lately Bank of Baroda has been aggressively running multiple offers increasing the interests of masses for their credit cards. Hence I decided to review their Premier Credit Card which I have been holding for the past one year. I will also be talking about my first hand experience with this credit card in this article. So without further ado, let’s get started.

Bank of Baroda Premier Credit Card comes in brownish-red color with a pattern of flowers. The card feels plasticky in hand and lacks premium feeling. The name and numbers are embossed in silver just like the majority of cards. Overall design of the card is very unattractive and vintage. Interestingly the card is also not enabled for contactless transactions unlike most modern credit cards.

Eligibility Criteria

Bank of Baroda positions Premier Credit Card as their top tier credit card and hence the income criteria is on the higher side.

- Age: 18 to 65 Years

- Income: Rs. 7.2 Lakhs per annum

Though an existing relationship with Bank of Baroda is preferred, but is not mandatory.

Fees

Bank of Baroda Premier Credit Card comes with following fees:

- Joining fee: Rs. 1,000 + GST

- Renewal fee: Rs. 1,000 + GST

Renewal fee is waived off if spends in the previous year is more than Rs. 1.2 Lakhs. Also, the joining fee is waived off if you spend more than Rs. 10,000 within 60 days of card issuance.

Features

Bank of Baroda Premier Credit Card comes with accelerated rewards and insurance cover. Let’s look into these in detail.

Welcome benefit

- 6 Months of Gaana Plus Subscription

Bank of Baroda is providing 6 Months of Gaana Plus subscription if you apply for the card on their website. Note that this benefit is for limited time and is available on other credit cards from Bank of Baroda too.

Reward Points

- 1 reward point = Rs. 0.25

- 2 reward points for every Rs. 100 spent on other categories, 0.5% reward rate

- 5X reward points on travel, dining and abroad spends, 2.5% reward rate

- Maximum cap on 5X reward points = 2,000 per month

-

Reward points can be redeemed for statement credit

2.5% reward rate on travel, dining and international spends is good, however a limit of 2,000 per month is disappointing. Also note that Bank of Baroda charges 3.5% + GST (~ 4.23%) as foreign currency markup fee and hence the benefit of accelerated reward points on international spends is diminished. However one good thing about the reward points is that they can be redeemed for statement credit.

Airport Lounge Access

Bank of Baroda Premier Credit Card provides access to domestic lounge using Visa Lounge Program.

- 4 complimentary lounge access per year within India

Absence of international lounge access on Bank of Baroda Premier Credit Card is certainly disheartening. Also I feel the annual limit for domestic airport lounge access is on the lower side.

Current Offers

Some of the notable current offers running on Bank of Baroda credit cards are listed below:

- Travel

- Up to Rs. 25,000 off on Domestic and International Flights and Hotels on MakeMyTrip

- Up to Rs. 40,000 off on Domestic and International Flights, Holiday Packages and Bus at Yatra

- 10% cashback on flights at Paytm

- 15% cashback on Indigo

- 12% off on domestic and 10% discount on international flights at Goibibo

- Cashback up to Rs. 2,000 on Vistara

- Rs. 1,000 off on domestic flights at Ixigo

- Hotel

- 40% off at Oyo Hotels and Rooms

- 20% off on Ginger hotels

- 30% off on Fab hotels

- Food

- 25% off on Zomato, up to Rs. 100

- 50% off on Fassos, up to Rs. 75

- 50% off on Oven Story Pizza, up to Rs. 175

- 75% off on Behrouz Biryani

- Entertainment

- 30% cashback on PVR, up to Rs. 150

- 50% cahsback on Paytm Movies, up to Rs. 125

- 25% discount on Inox, up to Rs. 150

- 25% off on Carnival Cinemas, up to Rs. 125

- Grocery and Kitchen

- 15% discount at Amazon Pantry, every Wednesday

- 20% discount on Wonderchef

- 7.5% cashback at LG Brand Stores

- Health and Wellness

- 30% off on medicines, 40% off on tests at 1mg

- 10% of Lybrate

The full list of offers on Baroda credit cards can be reviewed here.

Other Benefits

- 1% fuel surcharge waiver for all fuel transactions between Rs. 400 - Rs. 5,000 (maximum of Rs. 250 per month)

- 24/7 concierge

- 50% discount on Golf using Visa Golf offer

- Personal Accidental Death Cover for primary card holder

- Zero liability on lost card after reporting

Drawbacks

Some of the prominent drawback of Bank of Baroda Premier Credit Card are below:

- Low monthly limit on accelerated reward points: The limit of 2,000 on 5X reward points is really low and spends above this threshold earn reward points at rate of 0.5% which is quite low. Given that this card is top most variant from Bank of Baroda, a higher limit on accelerated reward points is highly desirable.

- Insufficient airport lounge access: 4 complimentary domestic airport lounge access in a year is really low. Absence international airport lounge access is a huge let down. I wish Bank of Baroda has provided better limits on complimentary airport lounge access, for both domestic and international airports.

Personal Experience

I applied for Bank of Baroda credit card on their website. Next day their representative called me for the KYC document collection and fixing the appointment. Same day their executive visited my place and collected following documents:

- 1 Passport Size photo

- Aadhar Card

- PAN Card

- 2 Months Salary Slip

- Latest IT Return acknowledgment

I filled out the form and selected Prime card as it’s free for lifetime. I wanted a Bank of Baroda credit card just to avail their periodic offers and never intended to use it as a primary card.

The card was approved quickly and was delivered to my home address in 5 days. To my surprise, when I opened the packet, I saw they issued me the Premier credit card instead of Prime. I was quite furious about this and emailed their customer care seeking an explanation. I didn’t get any satisfactory response and after a lot of back and forth I was told that I can downgrade the card in future.

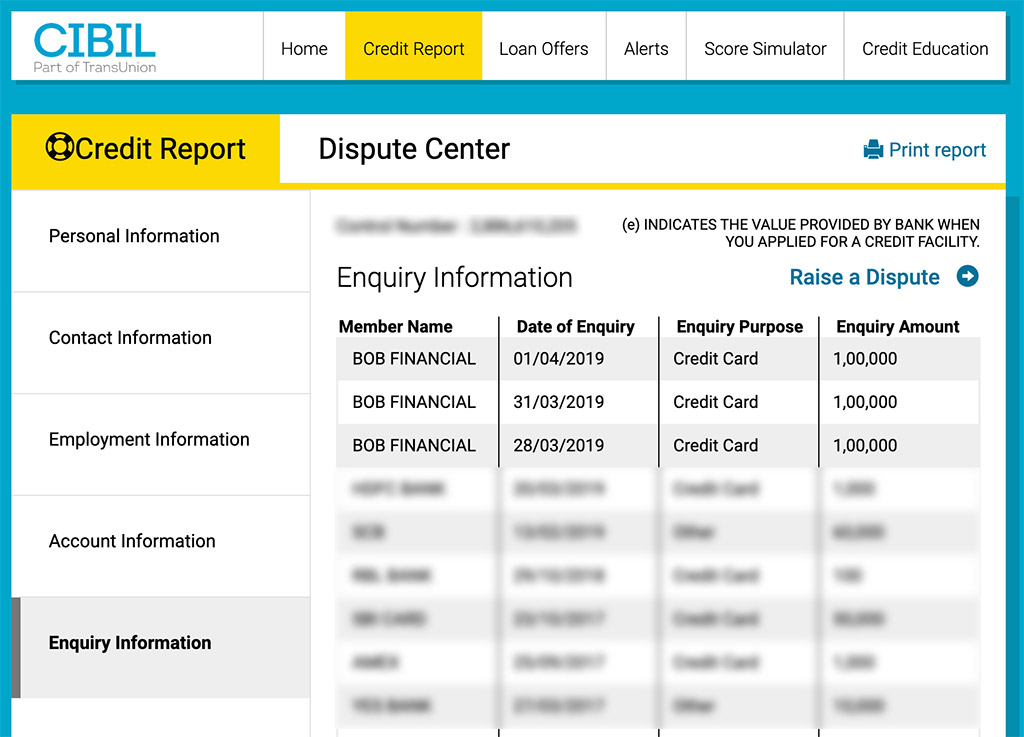

Later on when I checked my CIBIL report, I was shocked to see that they had made 3 enquiries in a short span of 5 days. Thankfully there was no adverse impact on my CIBIL score and it remained intact.

I decided, instead of engaging with their incompetent customer care executives, I will just cancel the card at the time of renewal.

I added the card to CRED for making the payment. When I made the payment via CRED, the payment got stuck and later got refunded to my account after 3 days. I had to make the payment via their net banking interface which is quite dated and not so user friendly. Finally I decided never to use the card owing to the hassle of making payments. I would be cancelling this card in the next few days parting my ways with Bank of Baroda for forever.

Verdict

Bank of Baroda is way behind their competitors in the credit card game. Their mediocre customer support and their questionable practices around credit enquiries are a huge let down.

Coming to Bank of Baroda Premier Credit Card, the card leaves a lot to be desired. The default low reward rate and comparatively high annual charges are deal breaker. I would suggest you to stay away from this credit card and look for others like HDFC Bank Regalia First Credit Card or SBI SimplyCLICK Credit Card which provides a better value.

If you need a card from Bank of Baroda just for their offers then stick with their no-frills Prime Credit Card which provides 1% cashback on all spends.

Are you planning to apply for Bank of Baroda credit card? Or if you have one already, how has been your overall experience? Either way, let me know by leaving a quick comment below.